Abstract

Chip semiconductors are compared to the oil of the 21st century. General cell phones, high-grade military weapons, 5G, and electric vehicles all require chip assistance to upgrade and are at the heart of many important technology products in this current era. Innovation in the semiconductor field is the basis for driving the global economy into the era of digital transformation, artificial intelligence (AI), and 5G communications. As a result, chip semiconductors are increasingly strategic in nature, critical to economic competitiveness and national security, and are seen by the U.S. as a key weapon in its technological competition with China.

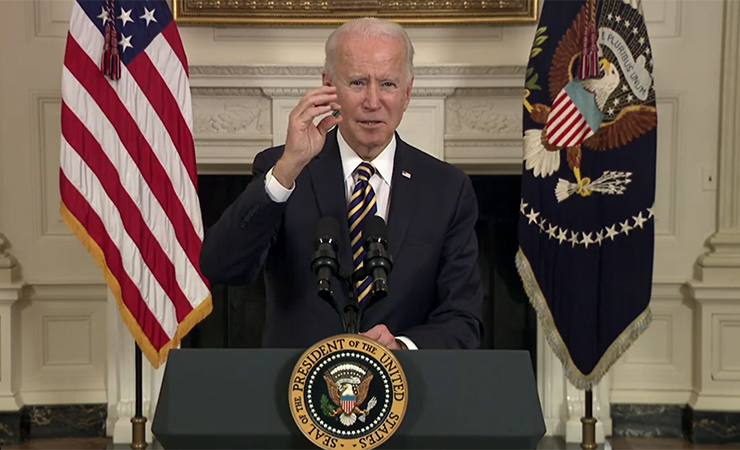

On August 9, 2022, U.S. President Joe Biden officially signed the Chip and Science Act (hereinafter referred to as the "Chip Act"). Previously, in March, the U.S. proposed the so-called "Chip 4 Alliance" (Chip 4), consisting of the U.S., Japan, South Korea, China, and Taiwan, and has been moving forward. Although the White House described the purpose of the bill as reducing costs, creating jobs, strengthening the supply chain, and promoting the return of semiconductor manufacturing, the U.S. attempts to hinder the development of China's chip is clear, especially in the bill sets "China guardrail" provisions, forcing semiconductor giants to choose sides in the U.S. and China's industrial policy. The U.S. is now using both hard and soft tactics to attract or pressure China's Taiwan and South Korean semiconductor giants to move in, aiming to improve the ability to manufacture chips locally, in an effort to build a U.S.-based "resilient" supply chain. The world pattern of Sino-US technological competition and ideological bipolarity will deeply affect the global layout of semiconductor companies, and the future global semiconductor industry will most likely be divided into regional industrial chains.

In this changing environment, how the governments of China, Taiwan, South Korea, and their semiconductor giants respond to the U.S. Chip Act and the technology decoupling between China and the U.S. has received widespread attention. This report will clarify the logic of the government and enterprises involved and provide policy recommendations for how China can break the game. The report introduces the division of labor in the semiconductor industry chain and the leading position of Taiwan and South Korea in global chip manufacturing, summarizes the specific measures taken by the U.S. to draw in its East Asian allies and impose a "technology embargo" on us, and analyzes the semiconductor giants of Taiwan and South Korea. The report analyzes how China, Taiwan, South Korea, and the government balance the pressure of "choosing sides between China and the U.S." and makes some policy recommendations on how China should effectively cope with the technology embargo dilemma.

Research Questions

-

Global semiconductor industry manufacturing capacity distribution

-

Analysis of policy trends in the U.S. semiconductor industry

-

Impact of the chip bill on China's semiconductor industry